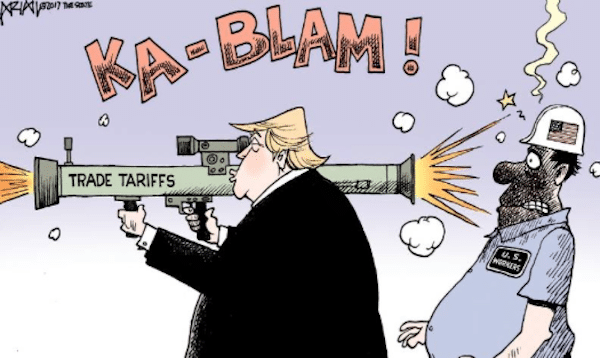

U.S.-Chinese trade war has been the hot topic of the week. Donald Trump’s 25 per cent tariffs on $34bn worth of Chinese imports and Chinese government threatening to impose tariffs on $60bn on US goods. Is it really easy to win the trade war?

The major consequences of these eco-political tensions are as follows:

- Rise of domestic prices – imposed tarrifs would increase the production costs; this will triger the inflation; this could lead to higher interest rates imposed by central banks.

e.g. washing machine prices in US have risen 16 percent since March 2018 - Slowdown of economic growth – higher domestic prices reduce consumer confidence as well as consumption, directly reducing the demand for goods; this will lead to lower level of GDP and lower rate of growth.

e.g Oxford Economics estimates that these tariffs will reduce each country’s economic growth by 0.1 to 0.2 % this year - Effects on stock markets – many firms focus on Chinese emerging markets in order to increase their earnings. As already mentioned we may expect slowdown of Chinese economy; reducing the demand for goods and services therefore – their profits too. However stocks may be supported by strong fundamentals.

Of course there will be many other impacts not only on these two economies but all the economies in the world. While Trump thinks that trade wars are good , it will have huge cost to it and there will only be loser.

Leave a comment